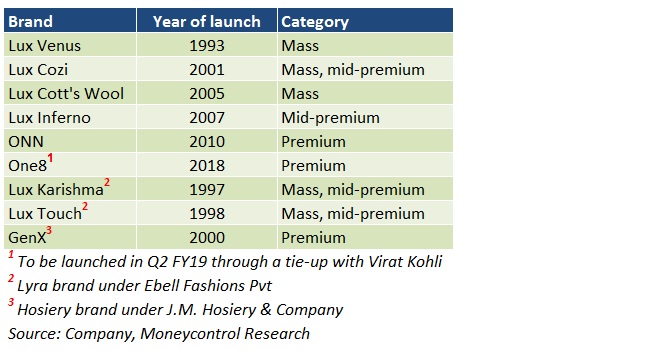

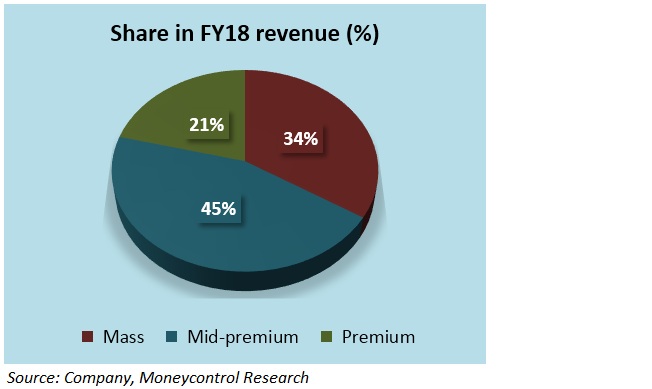

Lux Industries is one of India��s major innerwear-cum-leisurewear brands for men. Its product portfolio spans three categories��� mass, mid-premium, and premium. With 6 active brands in its kitty, product premiumisation on the agenda, network augmentation on the cards, and robust fundamentals to back its plans, the company��s prospects are promising.

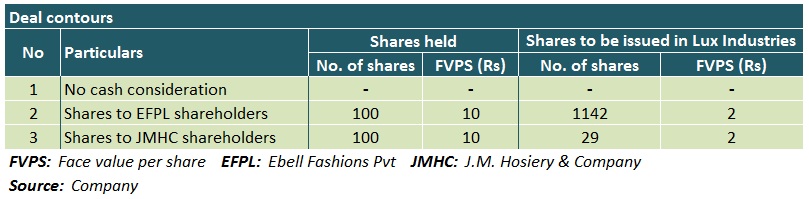

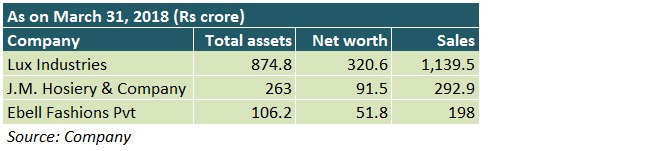

Recently, Lux announced an organisational rejig, wherein two entities (JM Hosiery�& Company, Ebell Fashions Pvt Ltd) of the promoters�� group will be merged into Lux. 48 lakh equity shares in Lux will be issued to shareholders of the 2 companies, cumulatively valuing them at Rs 861 crore. However, as per SEBI rules, post-merger, promoters�� shareholding will be eventually reduced to 75 percent.

related news Yes Bank receives SEBI approval to launch mutual fund business Plastics pipes: Multiple growth levers Buy Tata Steel; target of Rs 700: ICICI DirectJM Hosiery�& Company (JMHC) and Ebell Fashions Pvt Ltd (EFPL) are engaged in the business of manufacturing, marketing, sale and distribution of knitted apparel. While the former covers products made of hosiery (garments worn on the feet and legs), too, the latter deals in products only for women.

How does Lux benefit?

New brands: By virtue of the organisational rearrangement, 3 new brands will come under Lux��s already robust gamut of brands. These include Lux Karishma, Lux Touch and GenX. While the former 2 will help the company tap the fast-growing and evolving women��s leisurewear market in India, the latter, being a premium men��s innerwear brand, will fetch higher realisations per unit.

Risk mitigation: Historically, Lux��s products have been predominantly male-oriented since the market for the same has always been large in India. This, in turn, limits incremental growth. The amalgamation will, therefore, enable Lux to gradually increase the contribution of womenswear products to its annual revenues in due course.

Operational synergies: Though Lux��s future advertisement spends are likely to be brand-specific, marketing campaigns undertaken by the company will enhance the visibility of its entire basket of brands. Furthermore, the existing distribution channels and points of sale can be leveraged optimally to explore cross-selling opportunities.

Should you invest?

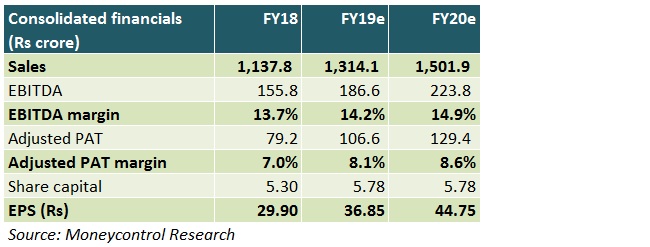

The deal should help Lux consolidate its strengths, introduce a new set of products (and/or variants of existing ones), achieve brand differentiation, and integrate business models of JHMC and EFPL with its own fairly easily. Besides bolstering Lux��s consolidated revenues, the reorganisation will curtail overhead costs since no additional capex would be necessary. This may lead to margin expansion.

Nevertheless, in the near-term, the move is expected to be earnings-dilutive, albeit marginally, on account of additional shares that would be issued to shareholders of JMHC and EFPL (ie Lux��s promoters). Secondly, declining brand loyalty attributable to intensifying competition from domestic/foreign brands remains a major risk.

Lux has managed to counter the sharp corrections lately observed in the midcaps space, apparent from a decline of only 7.5 percent from its 52-week high. At 43.3 times FY20 projected earnings, the stock leaves little upside scope for investors seeking an entry opportunity at current levels. Therefore, we recommend buying on weakness.

Follow @krishnakarwa152

For more research articles, visit our�Moneycontrol Research page First Published on Jul 4, 2018 05:18 pm

No comments:

Post a Comment