China is considering a plan to buy more American coal as part of an effort to narrow its trade deficit with the U.S., according to people with knowledge of the matter.

Chinese officials are currently looking at boosting purchases from West Virginia in particular, said the people, who asked not to be identified because they’re not authorized to speak publicly. They didn’t say whether Beijing is looking at buying more supplies from other states. A final decision hasn’t been made, they said.

The country’s top economic planner, the National Development and Reform Commission, referred questions to the National Energy Administration; officials there didn’t reply to an email seeking comment.

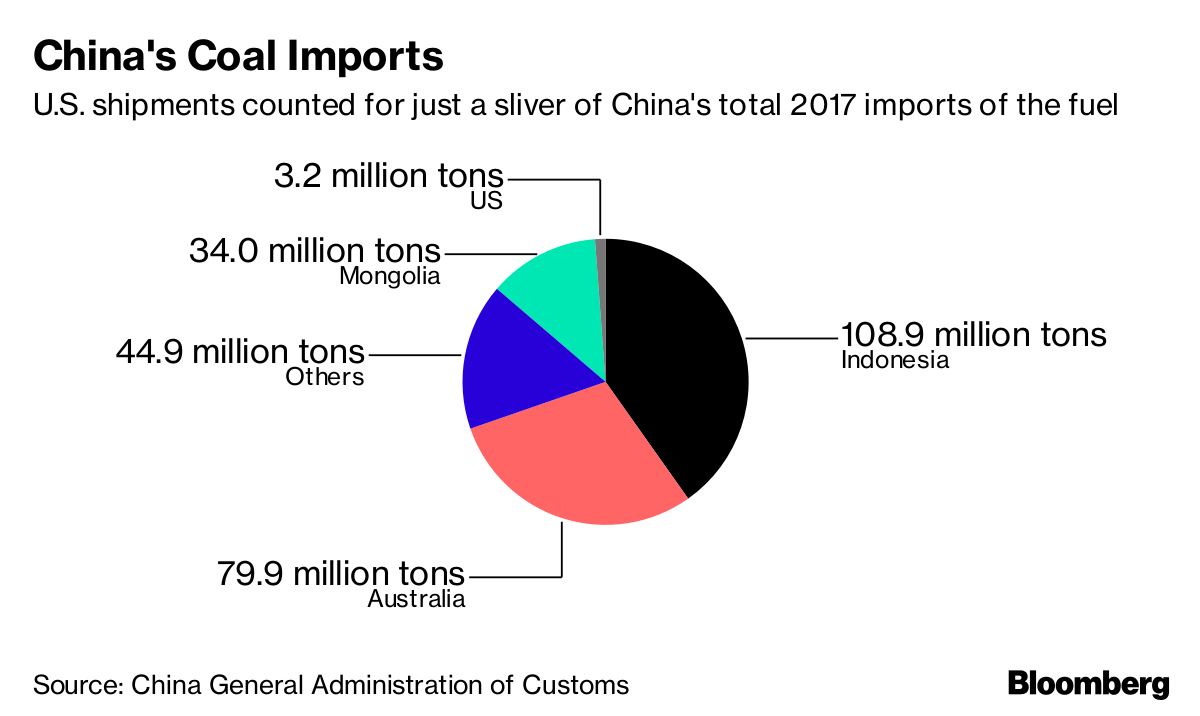

China's Coal ImportsU.S. shipments counted for just a sliver of China's total 2017 imports of the fuel

Source: China General Administration of Customs

.chart-js { display: none; }

China this month pledged to increase purchases of U.S. energy and agricultural goods as a way to reduce its $375 billion merchandise trade deficit and diffuse an escalating trade war between the world’s biggest economies. More imports by the Asian nation would be a boon for American coal-producing states -- including West Virginia -- that supported Donald Trump’s presidency on the back of his pledge to revive the ailing industry.

While China pursues a long-term goal of lowering coal’s share of its energy mix, the country still produces, consumes and imports more of the fuel than any other nation. It purchased 271 million metric tons from overseas last year, according to customs data. The U.S. exported about 3.2 million short tons to China, data from the Energy Information Administration show.

See also: China’s Coal Imports Seen Falling for First Time in Three Years

The U.S. more than doubled coal exports to Asia in 2017 to 32.8 million tons, while total overseas shipments rose 61 percent year-on-year. India was the biggest importer of thermal coal, used in coal-fired power stations, according to the EIA.

Trump has promised to revive the U.S. coal industry by lifting restrictions on it. In February 2017, he signed legislation repealing a regulation meant to protect streams from the effects of coal mining. In October, his administration proposed the repeal of the Clean Power Act, which was designed to cut carbon dioxide emissions from electricity generation.

Asia CallingU.S. coal exports to Asia including China have surged year-on-year

Source: Energy Information Administration

Note: Data is short tons

.chart-js { display: none; }

West Virginia was the second-biggest coal producer in the U.S. after Wyoming in 2016, accounting for 11 percent of the nation’s total output, according to the EIA. All of the state’s coal is bituminous with varying sulfur content, and about 75 percent is shipped out to other states and countries.

While Trump has since backed away from the economic truce reached between Beijing’s special envoy and the White House in Washington on May 19, U.S. Commerce Secretary Wilbur Ross plans to head back to Beijing early next month to continue talks. China has already said it will cut the import duty on passenger cars and there’s speculation more tariff reductions are on the way.

It wouldn’t be the first time that China’s trade policies affected Trump-supporting parts of the U.S. in particular. As the trade war ratcheted up earlier this year, China said it was considering harsher tariffs on soybeans, potentially harming the American farming industry that had backed the president, before walking back from the plan as the truce was reached.

— With assistance by Ben Sharples, Steven Yang, Martin Ritchie, and Aaron Clark

LISTEN TO ARTICLE 2:58 Share Share on Facebook Post to Twitter Send as an Email Print News coverage about Cisco Systems (NASDAQ:CSCO) has been trending somewhat positive this week, Accern reports. Accern scores the sentiment of news coverage by analyzing more than 20 million blog and news sources in real time. Accern ranks coverage of companies on a scale of negative one to one, with scores nearest to one being the most favorable. Cisco Systems earned a daily sentiment score of 0.19 on Accern’s scale. Accern also assigned news coverage about the network equipment provider an impact score of 47.3101748907934 out of 100, meaning that recent news coverage is somewhat unlikely to have an effect on the company’s share price in the immediate future.

News coverage about Cisco Systems (NASDAQ:CSCO) has been trending somewhat positive this week, Accern reports. Accern scores the sentiment of news coverage by analyzing more than 20 million blog and news sources in real time. Accern ranks coverage of companies on a scale of negative one to one, with scores nearest to one being the most favorable. Cisco Systems earned a daily sentiment score of 0.19 on Accern’s scale. Accern also assigned news coverage about the network equipment provider an impact score of 47.3101748907934 out of 100, meaning that recent news coverage is somewhat unlikely to have an effect on the company’s share price in the immediate future.  Piermont Capital Management Inc. cut its holdings in Teradata (NYSE:TDC) by 7.2% in the 1st quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 26,080 shares of the technology company’s stock after selling 2,020 shares during the period. Piermont Capital Management Inc.’s holdings in Teradata were worth $1,035,000 at the end of the most recent reporting period.

Piermont Capital Management Inc. cut its holdings in Teradata (NYSE:TDC) by 7.2% in the 1st quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 26,080 shares of the technology company’s stock after selling 2,020 shares during the period. Piermont Capital Management Inc.’s holdings in Teradata were worth $1,035,000 at the end of the most recent reporting period.  Media headlines about BLUCORA INC Common Stock (NASDAQ:BCOR) have been trending somewhat positive recently, Accern reports. The research group scores the sentiment of press coverage by reviewing more than 20 million news and blog sources in real-time. Accern ranks coverage of companies on a scale of -1 to 1, with scores closest to one being the most favorable. BLUCORA INC Common Stock earned a news impact score of 0.18 on Accern’s scale. Accern also gave headlines about the information services provider an impact score of 46.333017457894 out of 100, indicating that recent press coverage is somewhat unlikely to have an impact on the company’s share price in the immediate future.

Media headlines about BLUCORA INC Common Stock (NASDAQ:BCOR) have been trending somewhat positive recently, Accern reports. The research group scores the sentiment of press coverage by reviewing more than 20 million news and blog sources in real-time. Accern ranks coverage of companies on a scale of -1 to 1, with scores closest to one being the most favorable. BLUCORA INC Common Stock earned a news impact score of 0.18 on Accern’s scale. Accern also gave headlines about the information services provider an impact score of 46.333017457894 out of 100, indicating that recent press coverage is somewhat unlikely to have an impact on the company’s share price in the immediate future.